Summer 2023 Report

The Future of UK Interest Rates

Why Inflation & Interest Rates will stay high..

...and how to take advantage

This 10 minute read takes the form of chapters as below

- 1 - Who is this Report for?

- 2 - What’s the main argument?

- 3 - My experience in short

- 4 - This problem started in 2008…

- 5 - Inflation TYPES - Understanding the real issues behind Rate rises

- 6 - The Two Types of Inflation - 1 Demand or Supply Led

- 7 - The Two Types of Inflation - 2 Domestic or Imported

- 8 - Why aren’t the Media covering this?

- 9 - What could cause Interest Rates to drop?

- 10 - In Summary…

- The BoE is impotent to stop supply-led, imported inflation.

- Rates will remain high, causing shifts in build tech and finance

- 11 - Now the good news..how we can take advantage..

- 12 - What to do now..

- 13 - Links to non-mainstream economic thinkers and investors

1 - Who is this Report for?

This report is for UK property professionals who are concerned about the future of the UK property industry, and interested in trying to understand what the economic future might look like so they can plan accordingly.

2 - What's the main argument?

This report offers a different perspective on inflation and interest rates that will hopefully help property based business owners to make better business decisions.

The main thrust of this report is that interest rates won’t be coming down anytime soon, despite that being what most of us want and need, and in fact are more likely to go up over the next 2-5 years.

This will be due to specific types of stubborn inflation, despite what the media, the government or the Bank of England (BoE) will say.

It is my contention that we have two specific types of inflation that the BoE is unable to deal with using Base Rates.

The 2 types of inflation are:

1) supply side inflation i.e. supply shortages due to a world that is de-globalising supply chains over the next 10 years and..

2) imported inflation from energy prices and food prices, that cannot be controlled domestically, and are not included as part of the advertised core inflation numbers..

Energy price inflation is in any case also seasonal, which is why during the summer months, you will hear the news that inflation is coming down. I would argue inflation is not falling; we are merely not turning on our radiators during the warmer months.

Provided we do not have a black swan event (e.g. 2008/Covid), I believe the above is the most likely scenario.

We will then offer solutions for property professionals, particularly those in development and contracting. Those solutions, in order to regain lost profit margins, will be a construction move towards new technology, and a financing move from debt to equity.

I contend that those who sit on the fence and wait for rates to drop will likely be waiting a long time for that to happen. In the meantime, they will potentially miss out on opportunities to grow today.

It is hard to bring direct evidence of this line of thought, when the mainstream media has become so politicised and unable to tell us straight.

However, a number of fantastically smart macroeconomic investors, thinkers, commentators and hedge fund managers exist that you rarely see on prime time news. They tend to be not only smarter, but have more freedom in what they say, and therefore help us to get to the bottom of various issues like inflation. I will provide links to a number of them at the end.

3 - My experience in short

My name is Chris Davidson and I run the development finance brokerage Discover Development Finance, an arm of Discover and Invest Ltd.

I’ve been in the property industry since 2000, starting with a couple of small renovations, before moving into creating and selling Global City Buy-to-Let Investments for a London based firm.

In 2008, Discover & Invest was set up, brokering debt and equity finance for a variety of real estate projects and lenders both in the UK and Europe.

Having started with A Levels in Politics, Economics and History, the macro economic and political landscape has always been of interest to me. I aim to get under the bonnet to find the real truths where possible, and provide compelling and unique perspectives.

Let’s get going…

4 - This problem started in 2008...

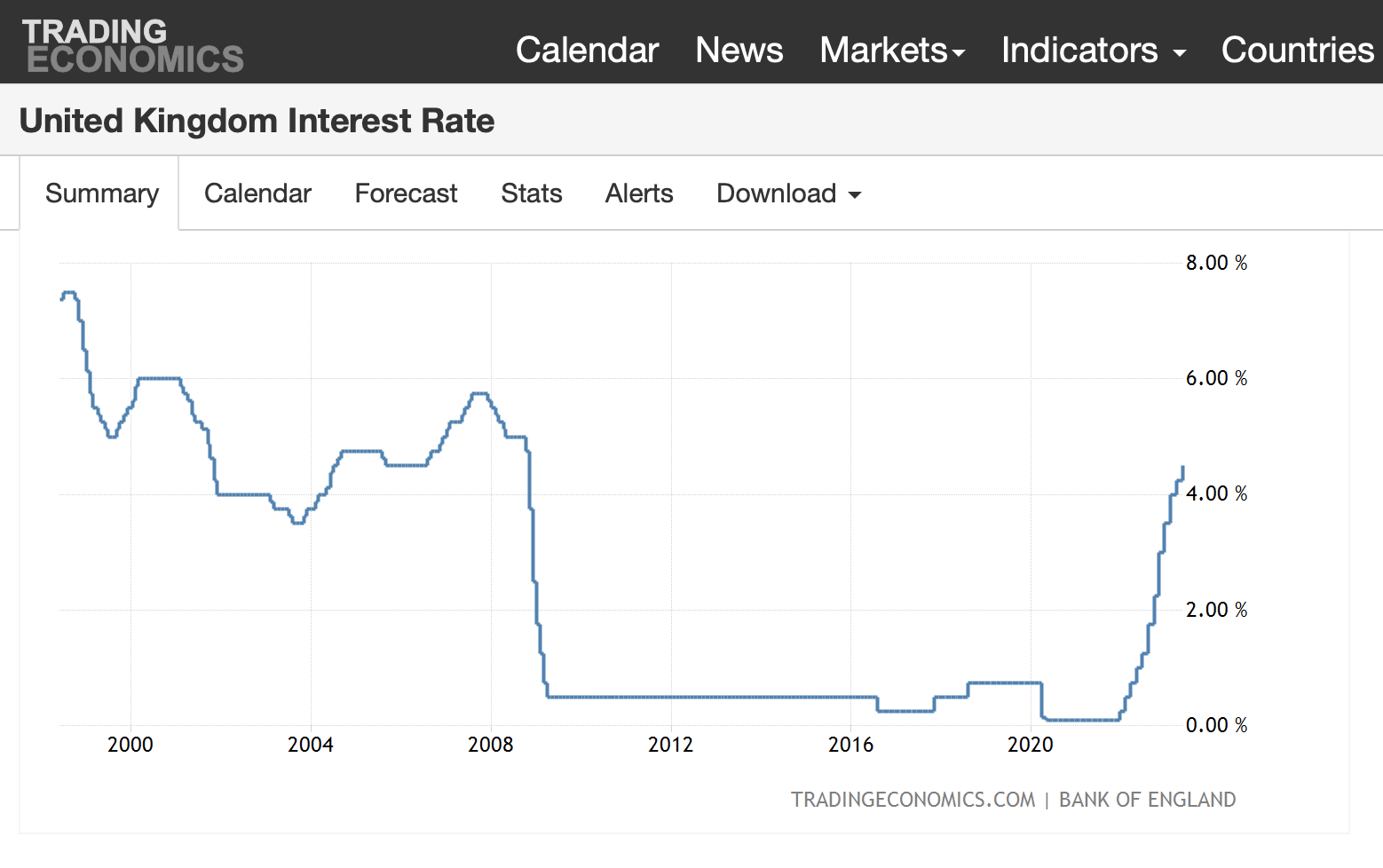

One of the most important factors in the property industry, if not the most important, is the Bank of England Base Rate.

This is the tool our Central Bank, the BoE, uses to control economic output in our country. It also has great impact on house building costs, the financing of house building, and the financing of the mortgages of the end buyers.

Since 2008, we have an economy (both local and global), that has been built and grown on base rates of 0%.

Now, with rates jumping to over 4% in only 12 months, we are starting to see the economic effects that these increases will have, particularly in property.

The system is not built for this level of interest rate.

Rate rises kill demand and reduce profit margins. And this at a time when margins in many industries like property were already being squeezed.

So why are rates rising?

5 - Inflation TYPES - Understanding the real issues behind Rate rises

Base Rates are rising because the world has an inflation problem, which we are all well aware of.

However, inflation is not one concept, it can be different types of inflation.

The media is not conducting this investigation, so we must take a deeper look into the different types of inflation, which types we have, and why we must understand this to assess where we are.

Just reading about “inflation’ as a general term is not enough..

6 - The 2 Types of Inflation

- 1 demand or supply led

Firstly, inflation can be either demand led or supply led.

Demand led means prices go up because demand has gone up.

It usually means we are in a boom period, with wages going up, everyone having access to loads of cheap credit cards, and we are all buying more holidays, cars, etc.

Supply led inflation means prices go up because the supply of those goods/services has gone down.

That is to say we have a shortage of said product or service, relative to the demand that has remained level.

Less goods to sell means the price usually goes up to compensate the supplier for otherwise lower revenue.

In this crude example, a car supplier now doesn’t sell 10 cars at £50k each, so he sells 5 cars at £100k each if he can get away with it.

We’ve seen this more recently with fuel prices and food prices.

What type of demand/supply inflation does the UK have?

We currently have supply led inflation due to global supply chain shocks caused by Covid. This is happening all over the world.

Covid showed that globalisation left countries at risk if the world shuts down, and there’s no guarantee it won’t happen again the future.

As a result of this new perspective, as well as geopolitical tensions, the world's countries are de-globalising to protect themselves from any future fall out.

De-globalising means building new factories at home, which can take 5-10 years to come to fruition.

Local wages will also be higher than previously outsourced jobs. De-globalising also means supply chain shortages are most likely to continue in the short to medium term, fuelling further supply led inflation.

From a BoE perspective, putting interest rates up does not change the fact that supply chain shortages exist in other parts of the world, and prices elsewhere will still rise.

7 - The 2 Types of Inflation

- 2 domestic or imported

The second type of inflation is tagged to the location where the goods or services are produced.

This can be domestic inflation, fuelled by strong local economic factors, or imported inflation, because products/services and their prices are made and set elsewhere.

What type of domestic/imported inflation does the UK have?

We largely have imported inflation, particularly within the sectors that hit the population the hardest, which are energy prices, and food prices.

In the UK we do not produce most of our own energy, nor much of our own food. We have put ourselves at risk by outsourcing most of these crucial economic requirements.

In a time of ongoing geopolitical tension, war, and potential food shortages, we are not in control of our own inflation, and neither is the BoE (who seem to have only just understood this).

Whatever you think of the Ukraine war, there is no incentive for Energy partners like Russia to drop prices at a time when they have economic sanctions placed on them, and they can turn the screw.

Energy price inflation is also seasonal. We don’t turn our radiators on in the summer months for example, so inflation drops. This is the main reason why I believe the inflation falling narrative during the summer abounds, and also why it is a false economy.

Let’s see what happens to inflation when the radiators go back on in November/December.

8 - Why aren't the Media covering this?

Firstly, expert analysis is dominated by political experts, not economic experts.

The generic talking heads aren’t deep enough versed in macro, and politically are required to communicate a much simpler “inflation narrative” to the public.

Secondly, the real economic experts at say, the Treasury or the BoE, are either incompetent, or, fully understanding all of this, simply cannot come out and say so publicly.

Governments will apply pressure to toe the party line, so vote losing narratives will bite the dust.

Ultimately you have to dig for yourself to find truth, and the mainstream media channels are unlikely to offer much evidence to validate our intuition that other issues are at play.

There are some excellent macroeconomic thinkers and investors on various internet channels and podcasts, some of whom occasionally get main news channel air time.

A list of the better ones are at the end of this report.

9 - What could cause Interest Rates to drop?

We’ve taken a world hooked on 0% interest rates for growth, and turned it into a new world with 4% interest rates. Most people can see we have a system not built for this.

As the US Central bank, the Federal Reserve said last year, they will keep hiking rates till something breaks. Great.

The effects of rate rises take time, and it may be in the next few months that we see further consequences, particularly with government debt ceilings.

The 2023 Banking crises in the US occurred because capital has fled the banks to government treasuries, which now offer higher rates of interest. The Law of Unintended Consequences perhaps.

Ultimately rate hikes could completely kill demand, although it’s hard to argue that demand for food and energy/heat will drop completely.

Big rate drops historically happen when a crisis emerges. We saw big rate drops during 2008, and the 2020 Covid Crisis.

It might take another crisis like one of those above to see a big rate drop, but does that mean we are back to normal? Obviously not, and there’s no point in a big rate drop, if a massive credit crunch follows along with it.

10 - In summary..

The Bank of England is impotent to stop supply led, imported inflation.

Rates will remain high, causing shifts in build tech and finance.

It is therefore my assertion, all things being equal and continuing, that:

Interest rates will stay high and go higher over the next 2-5 years, as the BoE foolishly tries to combat rising, imported, supply-led inflation with domestic demand busting policy.

Putting interest rates up will not doing anything to combat our types of inflation in the UK.

All rate rises will do is succeed in kicking people out of jobs and homes, whilst stubborn, medium term inflation periodically continues to surprise experts by rising, most notably in the winter months.

In my view, the BoE will continue with rate rises, in the face of continued inflation, as it’s the only tool they actually have in their armoury.

Governments will then respond with more fiscal policy by supporting the population with “free money” like Universal Basic Income.

The alternative scenario is we have a "black swan event" caused by these rate rises, but will leave us in no fit state to finance a property industry like 2008.

11 - Now the good news..how we can take advantage

The good news is that, in my main case scenario, there are going to be ways to profit, and to do so handsomely.

I do expect some major changes coming down the line in our industry, and changes we need to prepare for, to take advantage of:

1 - Technology to revolutionise build processes and costs

Profit margins will be regained in property and development by revolutionising the build process and build timeframe.

New tech such as 3D Concrete Printing is not that far away now.

Indeed, a number of proof of concept projects are underway in the UK in 2023.

For developers and contractors, these new types of tech will allow you to finish projects much quicker, and cheaper, and therefore allow you to regain profit margins through completing more projects per year than you are currently able to.

2 - A major move from Debt to Equity finance

My view is that debt finance will begin to retreat, as back end investors realise they can no longer get the returns they were once receiving.

Equally, debt providers, on slim margins already (most profit goes to the back end investors), will find a lack of demand means their operation will not be viable without charging more interest.

There are a number of other major issues with debt that will be ongoing.

Substantial Red-Book down valuations are not going away, and debt lenders have inflexible models when it comes to moving costs in an appraisal to profit share models.

Some debt lenders will go, and some will convert to equity providers.

On top of that, small equity investors, who have traditionally partnered with developers in order to secure the debt lending, have also retreated due to the lack of returns now available. Less equity availability means an inability to qualify for the debt, and projects being passed up due to a lack fo funding.

With regards large scale private equity, this type of finance already dominates many industries including student lets and hotels in property.

A concerted effort by recent governments to kill off the private Buy to Let sector has led to a much larger sector being born; The Build to Rent sector.

Funded by large equity, and pension funds, those renting in the future will be attracted to quasi hotel/concierge/service led apartment blocks. At present, housing stock for pension funds to buy is very low, so the building of these units is only now beginning

However, very soon, big business will have effectively taken over the private rental market.

Therefore, when it comes to developers and contractors, a combination of a change in technology, and a change in medium term funding options, should probably be understood now and prepared for.

12 - What to do now..

If you’re concerned about build costs, now is the time to start looking into new technologies like 3D Concrete Printing (which will be very financiable). We are aware of a number of firms we could point you toward, who are doing proof of concept work.

If you are concerned about funding, and want to keep working on profitable, regular projects despite the appearance of low margins, there are some innovative JV options available that allow you to:

- do as many projects are you can manage

- allows you to act as a cash buyer when acquiring sites (getting ahead of the queue)

- without putting in any of your own cash

- not being limited by equity limits

- and with no PGs nor exit fees.

If you’d like to know more..click here to email me direct…

13 - For more in-depth research, follow these investors and thinkers..

Unfortunately, the mainstream is just too generic when it comes to economics, and I include the broadsheets in that too.

However, there are plenty of macroeconomic investors, thinkers and analysts worth listening to, who have their own podcasts and channels.

The following are the ones I recommend and can be found quite easily on YouTube and the podcast platforms (click on links to view a selection of their recent interviews):

Lyn Alden - Lyn Alden Investment Strategy

MoneyMaker Podcast

https://www.youtube.com/watch?v=E4AHFoWgf6M

Kiril Sokoloff - 13D research & Stategy

Sohn Conference

https://www.youtube.com/watch?v=bMAm2S1M_IU

Brent Johnson - Santiago Capital

US Dollar Dominance

https://www.youtube.com/watch?v=ZV5GZHClsG0

Steven Van Metre - The Bond King

https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw

Real Vision Finance - Raoul Pal

https://www.youtube.com/@RealVisionFinance

Hugh Hendry - Eclectica Macro

Bloomberg Markets with Alix Steel

https://www.youtube.com/watch?v=8DehQKs2uZ0

Neil Howe - Demographer and Author of the 4th Turning

https://www.youtube.com/watch?v=u9EmSI12raQ

Oil Shortages to come - CNBC

https://www.youtube.com/watch?v=bWM_wemv_R8

Lowest Oil Inventories in 5 years - Bloomberg

https://www.youtube.com/watch?v=a65H4kQoe40

Phil Anderson - The 18.6 year Property Cycle

https://www.youtube.com/watch?v=RndBKEvl2LQ

Jim Rickards - ex US Treasury Dept.

https://www.youtube.com/watch?v=qJKDUcWjpLU

Charles Goodhart - author of the Great Demographic Reversal

Get in Touch

For further information please telephone us on: 07515 288276

Alternatively please complete the fields below and your enquiry will be answered promptly.

Discover Development Finance

Discover & Invest Ltd

85 Great Portland Street

London

W1W 7LT

chris@discoverandinvest.com

1. Could you do with regular, free info on the top lenders?

If ‘real-time intel’ appeals to you, learn more about our free seasonal Lender Comparison Data.

Find out more by clicking on the following link:

To continue with the section, click on any of the sections below:

- The Basics

- Preparing for Funding

- Assessing Lenders

- Explaining Jargon

- Did you Know?

- Asset & Liability

- Lender Comparison Data

- Blog

- Free Templates

Latest Market Data

Immediate Access to the Top 60+ Lending Options in UK Development Finance

To access the marketplace Lender Data, please submit your details

Our Insights...

Follow us on: